Introduction

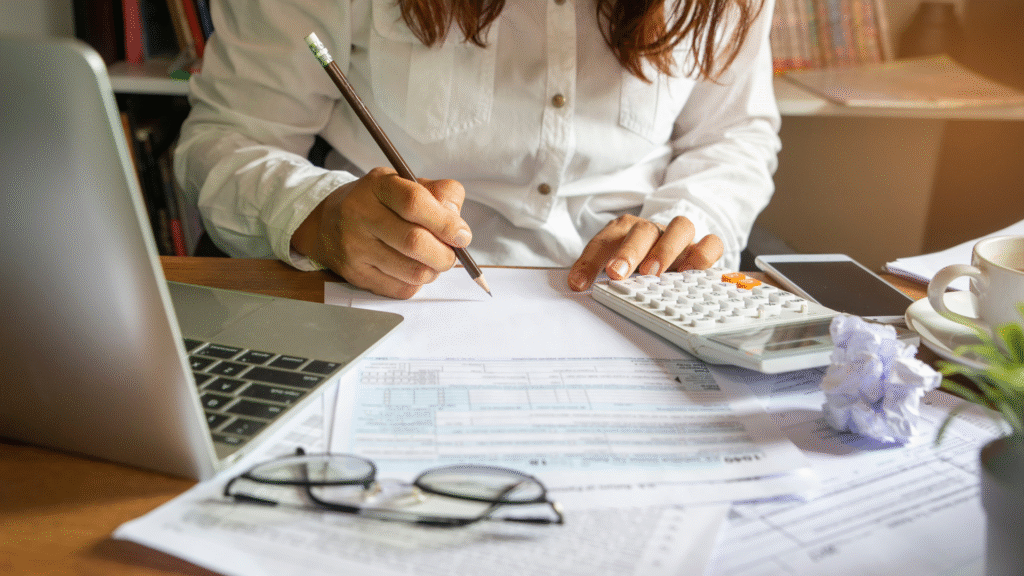

I remember that tough night at my kitchen table. Bills were spread out everywhere around me. The kids slept quietly in the next room. As a single mom, I felt buried under all those costs. One income covered rent, food, and kid needs. No partner helped split the heavy load. I cried a little bit that night. Then I found a simple budget plan. It changed my whole money situation fast. I saved $200 in the first month alone. No more worries late at night anymore. This article shares that exact budget plan and Smart & Easy Budget Plan Every Single Mom Should Know

It’s smart and easy to follow daily, Made just for single moms like us. We face really tough money issues often. But small steps can help a lot. I’ll cover basics, tools, and useful tips. You can do this right now. Start making changes today.

Why Single Moms Need a Solid Budget Plan

Single moms handle a lot of daily tasks. Kids need clothes that fit them well. School supplies add up quickly each year. Food bills grow with hungry little mouths. One paycheck stretches very thin sometimes. No second income provides any backup. Emergencies can hit really hard. A sick kid means extra doctor bills. Car breaks down and needs repairs? That brings even more costs. I know this from my own experiences. My son needed braces last year suddenly. It wiped out all my savings fast. But a budget plan fixed that problem. It shows where your money goes exactly. You spot waste and cut it out. Save cash for what truly matters.

Budget planning builds real security over time. It lowers your daily stress levels. You sleep much better at night. Kids learn important lessons too and they see how you plan carefully. It teaches them about money value. My daughter now asks before buying things. That’s a big win for us. A good budget plan fits your life. No strict rules hold you back, Just track spending and adjust often. Single moms really need this tool. It gives you full control. You decide all the spending choices. Not the bills that pile up.

Step-by-Step Guide to Creating Your Budget Plan

Start with the basics right away. Track your income first each time and write down your main paycheck amount. Add any child support or side money. List out all your expenses clearly, Rent takes a big chunk usually. Utilities come next on the list. Groceries and gas add up fast, Kid stuff fills the rest often. Do this tracking for a full week. Use a simple notebook for notes and note down every single dollar spent. Bought coffee on the way? Write it right away. Got a toy for the kid? Add that to the list too. This shows your spending patterns clearly. I saw I spent $50 on snacks. That was way too much money. I cut it and saved it quickly.

Set your goals next in line. What do you really want to achieve? Build an emergency fund first maybe. Pay off some debt over time. Plan a small family trip soon. Make those goals feel real. Aim for $100 saved first month. Break it down into smaller parts. Save $25 each week to hit it. That’s easy to reach consistently. Categories help organize everything well. Fixed costs like rent stay the same. Variable ones can change each month. Groceries vary based on needs.

Fun money should stay small. Keep it under $50 total. Adjust for single-mom daily needs. Childcare costs a lot every month. Plan ahead for that expense. Work hours shift around often? Build some flex into it. This budget planning step is truly key. It forms your strong base plan and updates it every single month. Life changes happen all the time. Kids grow and need more. Bills can rise without warning, Check everything and tweak as needed. I do mine on Sundays. It takes just 20 minutes total. Feels really good after finishing. You gain real power this way. Money starts working for you now. Not against you like before.

Essential Tools for Budget Planning

Tools make budget planning much simpler. Start with free options first. No need to spend any money. A free budget plan gets you started. Many are available online easily. Download one and fill in numbers. That’s quick and straightforward to do. Digital options work really well too. Budget planning software tracks things automatically. Apps link right to your bank. See all spends in real time. Mint is a free app choice. It sorts costs into groups. Shows simple graphs for viewing. Easy to use every day. Good for those busy mom days. Picking up kids from school? Check the app super quick.

Paper tools suit some moms better. A printable monthly budget template works great. Just print it out at home. Write everything by hand neatly. Sections cover income and all costs. I use one like that often. It feels more real to me. No screen is needed at all. Find free ones on mom blogs. Or check library sites for downloads. Compare the tools side by side. Software saves a lot of time. It updates on its own. But it needs good internet access. Printable works offline no problem. Always there when you need it. And it’s cheap with no fees.

I tried both types myself. Software for quick daily checks. Printable for bigger planning sessions. Mix them to fit your needs. It suits single-mom life perfectly. Where can you get them? Search for “free budget planner” online. Stick to trusted sites only. Avoid any potential scams out there. Community centers offer free classes. They hand out tools during sessions. Start with just one today. Set it up in minutes. Track for a full week. See fast changes in spending.

How Moms Can Save Money Fast: Easy, Real-Life Tips That Work

Saving Money Tips to Supercharge Your Budget Plan

Saving money tips boost your budget plan. Groceries eat up cash every month. Plan your meals ahead of time. Make a strict shopping list. Stick to it no matter what. Buy store brands for everything. They’re cheaper with the same taste. Bulk items last a long time. Rice and pasta save money. Cut $30 off each trip easily. I cook big pots at once and freeze half for later meals. No more takeout orders needed. Kids love home cooking. We get more time together too.

Kid costs add up really fast. Clothes grow out in no time. Swap with friends for free outfits. Community events cost zero dollars. Parks and libraries offer fun activities. No spending required at all. DIY crafts work well at home. Use old boxes for projects. Kids play for hours happily. This saves on new toys.

Utilities drain your money monthly. Turn off lights when not needed. Unplug chargers to save energy, wash clothes in cold water only. Your bill drops $20 easily. Call your providers right away and ask for any available deals. They often give discounts quickly. I saved $15 on internet service. Small wins like that add up.

Side income can help a ton. Fit it into your schedule. Do online surveys during nap time. Earn $50 extra each month. Sell old kid clothes online. Use apps like Facebook Marketplace. Sales happen easily and fast. I made $100 last month alone. Tie these saving money tips in. Update your budget planner with savings. Watch your fund grow steadily.

A monthly budget planner keeps you on track. Build it in a simple way. Divide everything by weeks clearly. Week one: Pay the rent first. Week two: Handle groceries and basics. Include your income pay days. Mark all bills that are due. Add a section for surprises. Like unexpected doctor visits. Or sudden school fees that pop up. Single moms need this buffer zone. Income varies from month to month? Plan on the low side. Save extra when it’s high.

Sample layout: Top for monthly income total. Middle for all spending categories. Bottom for the final totals. Use a printable monthly budget template. Fill it in with your numbers. Example: Income is $3,000 total. Rent takes $1,000 each month. Food budget at $400 max. Savings goal of $100 set. Adjust it to fit you. Track everything weekly without fail. Do a Sunday review session. Did you stay under budget? Give yourself a quick pat. Went over a bit? Cut back next week.

How to Create a Family Budget That Actually Works in 2025

Real-Life Examples and Success Stories

Real stories can inspire you a lot. My friend Lisa is a single mom. She has two young kids at home. She used a free budget plan. Paid off $500 debt in three months. Cut out all eating out completely. Saved $150 from that change. Now she has emergency cash ready. Another mom named Sarah tried it. She relied on saving money tips. Switched to generic brands everywhere. Saved $80 on groceries monthly and afforded a fun weekend trip. Her kids were absolutely thrilled.

Avoid common mistakes to stay successful. Ignore those small daily spends? They pile up over time. Log every single one carefully. Don’t skip your regular updates. The budget planner goes stale fast. Check it monthly with no exceptions. Share plans with a close friend. Accountability helps keep you motivated. These moms succeeded with hard work. You can do the same thing. Budget planning builds strong habits slowly. It leads to long-term security.

You now know this smart budget plan. Start with basic tracking today. Pick a tool like planning software. Or try a printable template instead. Add in those saving money tips. Update your monthly budget planner often. Small steps lead to big changes. Download a free budget planner now. Try just one tip this week and you deserve some real peace. Single moms are incredibly strong. This plan proves it every day. Resources are listed below. Good luck with your journey.

FAQ: Smart & Easy Budget Plan for Single Moms

I get lots of questions from single moms like you. After reading the article, you might wonder about the details. Here’s answers based on my own tries. I keep it simple and real. Let’s dive in.

Basics of Budget Planning

Q: Why do single moms need a budget plan so much?

A: Single moms juggle everything on one income. Costs like rent and kid needs add up. A budget plan shows where money leaks out. It cuts stress and builds savings fast. I saved $200 my first month using one.

Q: How does budget planning help with daily stress?

A: It gives you control over your cash. No more surprises at bill time. You spot waste and fix it quickly. Kids learn money smarts too. Sleep better knowing you’re set.

Q: What if I’m too busy with budget planning?

A: Start small with just 10 minutes a day. Track spends in a notebook first. It fits into nap time or evenings. Small steps make it easy to stick with.

Step-by-Step Budget Setup

Q: How do I start tracking income and expenses?

A: Write down your paycheck and any extras. List all costs for a week. Note every dollar on rent or snacks. Patterns show up right away. Adjust from there.

Q: What goals should I set in my budget plan?

A: Pick real ones like an emergency fund. Or pay off a small debt. Aim for $100 saved first month. Break it into weekly bits. Makes it easy to hit.

Q: How often should I update my budget plan?

A: Check it weekly for quick fixes. Do a full review each month. Life changes like kid growth happen. Tweak to keep it current. I do mine on Sundays.

Tools and Resources

Q: What’s a good free budget plan to start with?

A: Look online for simple downloads. Many sites offer free budget plans. Fill in your numbers easily. No cost to try one out. Trusted mom blogs have them.

Q: Should I use budget planning software or paper?

A: Software like Mint tracks auto from your bank. Good for quick checks on the go. Paper like a printable monthly budget template feels hands-on. Mix both if you want.

Q: Where can I find a printable monthly budget template?

A: Search mom sites or library resources. Print one with sections for income and costs. It’s free and easy to use. Customize it for your family needs.

Q: Is budget planning software hard to set up?

A: Not at all for most apps. Link your bank in minutes. It sorts spends into groups. Free versions work great. Pick simple ones for busy days.

Saving Money Tips

Q: What saving money tips work best for groceries?

A: Plan meals and make a list. Buy store brands and bulk items. Cook big batches to freeze. I cut $30 per trip this way. Stick to your budget planner.

Q: How can I save on kid-related costs?

A: Swap clothes with other moms. Use free parks or library events. Do DIY crafts at home. Saves on toys and outfits. Kids have fun without spending time.

Q: Any saving money tips for utilities and bills?

A: Turn off lights and unplug things. Wash in cold water. Call providers for deals. I saved $15 on the internet. Small changes drop bills quickly.

Q: How do I add side income to my budget plan?

A: Try surveys during kid naps. Sell old clothes on apps. Fits single-mom schedules. Add earnings to your monthly budget planner. Boosts savings without much effort.

Customizing and Real-Life Advice

Q: How do I build a monthly budget planner?

A: Divide it by weeks with income days. Mark bills and surprise costs. Use a printable monthly budget template. Track and review each Sunday. Adjust as needed.

Q: What mistakes should I avoid in budget planning?

A: Don’t ignore small spends that add up. Log everything every time. Skip updates and it goes stale. Share with a friend for accountability. Stay on top.

Q: Can real single moms succeed with this budget plan?

A: Yes, like my friend who paid off debt. She cut eating out and saved $150. Another afforded trips with tips. You can do it too. Start small today.

Remember this budget plan is for you. Pick tools like a free budget planner. Add saving money tips that fit. You’ve got the strength. Keep going strong.