Introduction

Picture this, Your family faces a surprise car repair bill. It wipes out your savings. Stress builds up fast. A good budget planner can stop this cycle. It helps track money and build habits that last. This article “How to Create a Family Budget That Actually Works in 2025” shows you how to use a budget planner well. We focus on real steps for families. A budget plan does more than list numbers. It creates smart choices for your money. You will learn about budget planning tools and saving money tips. These make your monthly budget planner work every day.

Families deal with changing costs. Think school supplies or family trips. A solid budget plan keeps things in check. Stick with it, and you gain control. No more money worries at night. Let’s get started.

Understanding the Basics of a Family Budget Planner

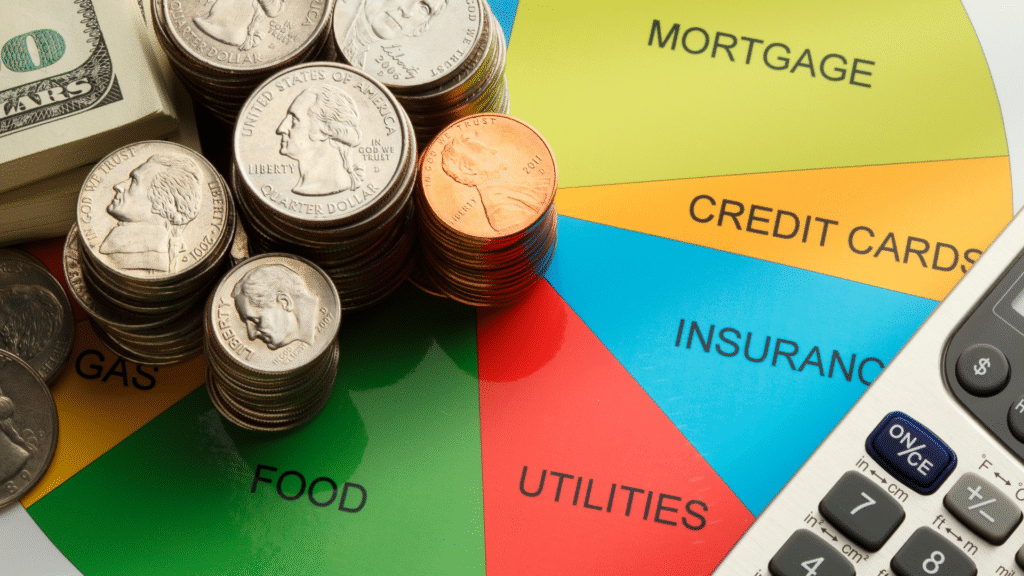

A budget planner is a tool to organize your money. It tracks what comes in and what goes out. You can use it on paper or with an app. The goal is clear: see where your cash flows and you have choices. A budget planner template is a simple sheet you fill in by hand. Budget planning software runs on your phone or computer. It pulls data from your bank. Both help make budget plans that fit your life.

Families benefit most. Kids add extra costs like sports or clothes. A budget planner lets everyone join in. Dad tracks bills, Mom logs groceries, and kids learn about saving. This team approach makes the plan stick.

Start small and list your income first. Then note fixed costs like rent. Add fun stuff like movies. A monthly budget planner breaks it down by weeks. Do you spot patterns quickly and overspend on eating out? Cut back there. Tools vary, some are free, others cost a bit. Pick one that feels easy. The key is to use it daily. A good budget plan shows your true picture, No guesses just facts.

Choosing the Right Budget Planner for Your Family

First, think about your family and how many people? Do you like tech? A big family needs room for lots of categories. If you hate apps, go simple. Look at options, A budget planner template is often free. Download it from sites like Google. Print it or use it online. It has spots for income and bills.

Budget planning software adds power. Apps like YNAB link to your accounts. They send alerts if you spend too much. EveryDollar is another, It helps build budget plans fast. You can mix them. Start with a template and move to software later. Make sure it fits your budget plans. Need debt tracking? Pick one with that.

Here’s a quick table to compare:

| Type | Pros | Cons | Best For |

| Budget Planner Template | Free, easy to change, no tech skills needed | You update by hand | Families who like paper |

| Budget Planning Software | Tracks spending automatically, sends reminders | May cost money, takes time to learn | Families with phones always on |

| Printable Monthly Budget Planner | You can carry it, see it clearly | Easy to lose or forget updates | People who like visuals |

Test a few, many offer free trials. Your choice should make budget planning simple.

Step-by-Step Guide to Setting Up Your Budget Plan

Ready to build your budget plan? Follow these steps. They work with any budget planner.

Step 1: Collect your money info

Pull bank statements from the last three months. Note all income. Include paychecks and side jobs. List every expense, rent, gas, coffee runs and be honest.

Step 2: Set goals you can reach

Talk as a family, Want to save for a trip? Or pay off a loan? Make goals clear and short ones like “build a $500 emergency fund.” Long ones like “save for college.”

Step 3: Sort into groups

Use your budget planner template. Common ones: home costs, food, transport, fun. Add family-specific things like kid care or pets and assign amounts to each.

Step 4: Put data in your tool

For a monthly budget planner, fill one month at a time. Budget planning software does math for you. Enter $3,000 income. Set $1,000 for rent. It shows what’s left.

Step 5: Check and fix

At month end, compare plans to real spending. Spent too much on clothes? Adjust next month. Do this every 30 days, Your budget plans get better over time.

These steps take an hour at first and then less. Soon, it feels normal.

Implementing and Maintaining Your Budget Planning Strategy

Now, put your plan into action. Daily habits matter. Log spends right away and uses your budget planner app on your phone. Bought lunch? Enter it now. No forgetting,Weekly checks help. Sunday night, review the week. Did you stay under the food budget? Pat yourself on the back. Or fix small slips.

Get the family involved and hold short meetings. Once a week, talk about money. Kids can share ideas. “Let’s skip takeout and cook.” This builds buy-in, Everyone owns the budget plan.

Track how you do. Budget planning software often has graphs. See your savings grow.

A budget planner template needs manual adds. Use colors: green for good, red for over.

Stick with it through ups and downs. A surprise bill hits? Adjust other areas and cut fun spending that month. Maintenance is key. Miss a week, and old habits creep back.

Over time, you see changes. More money in savings and less stress. Your monthly budget planner becomes a habit. Like brushing teeth.

Saving Money Tips to Maximize Your Budget Planner’s Effectiveness

Your budget planner shines with smart tips. These saving money tips boost results.

Try the 50/30/20 rule. Put 50% of income to needs like rent and food. 30% want hobbies. 20% to savings or debt. Plug this into your budget plan.

Plan meals ahead. Groceries eat up cash, make a list and shop once a week. Use your monthly budget planner to track. Families save hundreds this way.

Hunt for deals on bills. Call your cable company and ask for lower rates. Many say yes, Note savings in your budget planner template.

Cut unused subs. Check bank statements. Cancel that gym you skip. Apps in budget planning software flag these.

Build an emergency fund. Aim for three months of costs. Add a bit each paycheck. Your budget plans should include this spot.

Pay debt smart. List debts in your tool and pay high-interest first. The snowball method works: clear small ones quick for wins.

Real families succeed. One cut eating out and saved $200 a month. Another used software alerts, Avoiding overdrafts. They applied these tips daily.

Combine with your planner. Review monthly and spot weak areas. Adjust, savings add up fast.

Common Mistakes to Avoid and Troubleshooting

Budgeting trips people up all the time. I’ve seen families make these errors over and over. Let’s break them down with real fixes that stick. No fluff, just what works.

1. Plans That Are Way Too Tight

The Problem: You set up a budget plan with zero room for slip-ups or random fun.

Why It Sucks: Real life doesn’t follow rules. One surprise bill, and you feel like a failure. The whole thing falls apart.

How to Fix It: Loosen up a bit. Set aside 5 to 10 percent for “just in case” stuff. That way, a movie night won’t wreck everything.

2. Forgetting Those Weird One-Off Costs

The Problem: You leave out things like birthday gifts or a flat tire fix.

Why It Sucks: They pop up and hit your wallet hard. Suddenly, you’re scrambling and dipping into savings you meant to keep.

How to Fix It: Stick a “random stuff” spot in your budget planner. Throw in $50 or so each month. If you don’t use it, roll it over.

3. Letting Little Spends Slide By

The Problem: You skip tracking small buys, like a quick coffee or app download.

Why It Sucks: Those tiny hits add up fast. Before you know it, you’ve blown $200 on nothing big.

How to Fix It: Write down every single spend in your budget planning software right away. Do a quick check each Sunday to spot the sneaky ones.

4. Not Keeping Things Fresh

The Problem: You only touch your budget planner every few months.

Why It Sucks: Numbers get old and wrong. Your budget plan turns into a guess, not a guide.

How to Fix It: Make it a habit. Set a phone reminder for Friday nights. Spend ten minutes updating your budget planner template. Easy win.

5. Going Solo on the Plan

The Problem: You build the budget plan by yourself, no input from the crew.

Why It Sucks: Your spouse or kids ignore it. They spend without thinking, and resentment builds.

How to Fix It: Call a quick family huddle. Ask for ideas, like “What if we do game nights at home?” Makes everyone feel part of it.

6. Mixing Savings with Everyday Cash

The Problem: You keep your saved money in the same account as bill money.

Why It Sucks: It’s too easy to grab from it for “just this once.” Poof, your nest egg shrinks.

How to Fix It: Open a separate savings spot. Label it something clear, like “Rainy Day Cash.” Use your budget planning software to auto-move money there each payday.

Extra Fixes for When Things Go Wrong

- Dealing with Overspending:

What Usually Causes It: Bad days lead to impulse buys, or you didn’t plan well.

Quick Fix: Pause and think, “Is this a must-have?” Trade pricey outings for free stuff, like a walk in the park.

- When the Tools Feel Like a Hassle:

What Usually Causes It: The budget planning software overwhelms you with buttons and graphs.

Quick Fix: Start basic. Grab a plain budget planner template from online. Or pick easy apps like EveryDollar that walk you through.

- Hitting a Motivation Slump:

What Usually Causes It: Weeks of tight budgets wear you down.

Quick Fix: Give yourself a breather week with a little extra wiggle. Then tighten up. High-five over wins, like “Hey, we stashed $50 this time!”

- When Debt Feels Like a Monster:

What Usually Causes It: Loans with high rates eat your budget plan alive.

Quick Fix: List them in your budget planner. Tackle the worst interest ones first. Chip away steady.

Wrapping It Up

Dodge these goofs by building in buffers, chasing every penny, updating often, and looping in the family. Families I know turned things around like this. One switched to flexible plans after a big overspend mess. Another used app reminders to kill bad habits. Tweak as you go. Sticking with it matters more than getting it perfect right off.

Conclusion

You now know how to use a budget planner. From basics to tips, it’s all here. Pick a tool like a budget planner template or software. Set up your budget plan step by step. Involve your family. Use saving money tips to grow your cash. Start today and grab a free monthly budget planner. Enter your numbers, Watch changes happen. Consistent effort pays off and you get financial peace. Tools improve yearly, with smarter apps in 2025. Make it yours. Your family wins.

Frequently Asked Questions

Q1. What is a budget planner?

Man, it’s just a basic setup—like a notepad, an app on your phone, or some software—that lets you jot down your cash coming in and all the ways it sneaks out. Keeps things straight.

Q2. Do I have to pay for a budget planner?

Heck no. I’ve grabbed free ones myself. Stuff like printable budget planner templates, or apps such as EveryDollar. Even Google Sheets? Totally free and handy.

Q3. How often should I update my budget plan?

I’d say once a week, no more. I do mine on Friday evenings, takes about ten minutes to tweak the numbers and keep it real.

Q4. My spouse hates budgeting. Any tips?

Yeah, that happens. Try a quick chat, maybe five minutes over coffee. Let them pick something small, like ditching one pizza night a week. Get them on board without the hassle.

Q5. What if my income changes every month?

Tricky, but here’s what I do: base it on your crappiest month lately. Any bonus cash? Shove it right into savings or knock down some debt. Works like a charm.

Q6. How much should I set aside for surprises?

Shoot for five to ten percent of what you bring in each month. Most families I know swear by that—it covers the random junk without stressing you out.

Q7. Can kids help with budget planning?

Absolutely, get them in on it. Hand over a little section for their “fun bucks.” They start tracking what they spend, and boom, they learn to pick smarter.

Q8. I keep overspending on groceries. What’s the fix?

Ugh, groceries get me too sometimes. Plan out your meals for the week, make a strict list, and snap a pic of every receipt to log in your budget planner. Cut the waste quickly.

Q9. Is budget planning software safe?

From what I’ve seen, the good ones are solid—they use the same security as banks. I always flip on that two-step login thing for peace of mind. Never had an issue.

Q10. How long before I see results?

Give it two or three months of sticking with it, and you’ll spot the difference. Families I’ve talked to start seeing extra money pile up around then, if they track steady.